Stop Relying on P/E Ratios - Retirement Daily on TheStreet: Finance and Retirement Advice, Analysis, and More

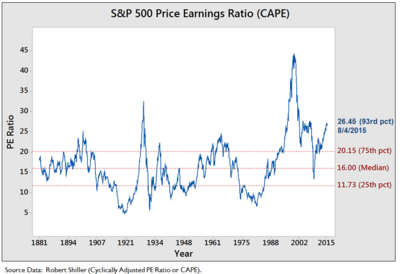

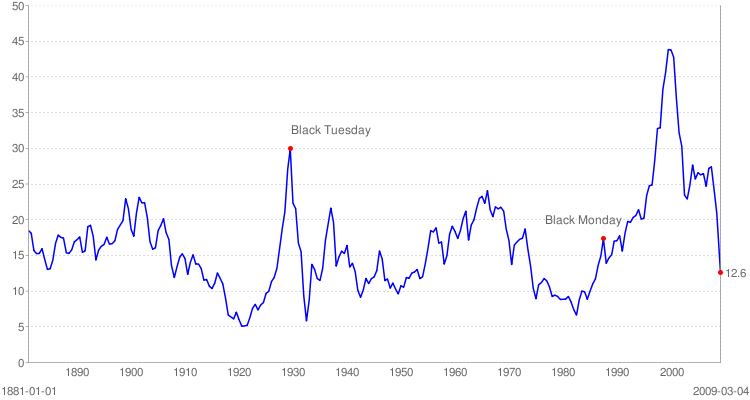

S&P 500 PE Ratio - How the Price Earnings Ratio Helps You to Valuate the Companies in the Standard and Poor 500 - UndervaluedEquity.com

![S&P 500 PE Ratio [Historical Chart By Month 1900-2023] S&P 500 PE Ratio [Historical Chart By Month 1900-2023]](https://finasko.com/wp-content/uploads/2022/03/Standard-Deviation-of-PE-Ratio.png)

Insight/2020/03.2020/03.13.2020_EI/S%26P%20500%20Forward%2012-Month%20PE%20Ratio%2010%20Years.png)

Insight/2022/02.2022/02.25.2022_EI/sp-500-forward-12-month-pe-ratio-five-years.png)

Insight/2022/05.2022/05.16.2022_TOW/sp-500-forward-12-month-pe-ratio-10-years.png?width=672&name=sp-500-forward-12-month-pe-ratio-10-years.png)